Is Every Company Becoming a "Women's Health" Company?

Plus a case study on Oura & how to build for women the *right way*

I’ve been thinking a lot about what makes a women’s health company a “women’s health” company. Is the defining characteristic rooted in the product or service, the brand, or the buyer?

Depending on how you answer this question, you’ll get a very different list of “women’s health” companies. Here’s my take: a women’s healthcare company is any company who directly serves women’s health needs and/or sells their healthcare product to women. (Yes, brand matters, but is not the defining characteristic; you can’t put lipstick on a pig!).

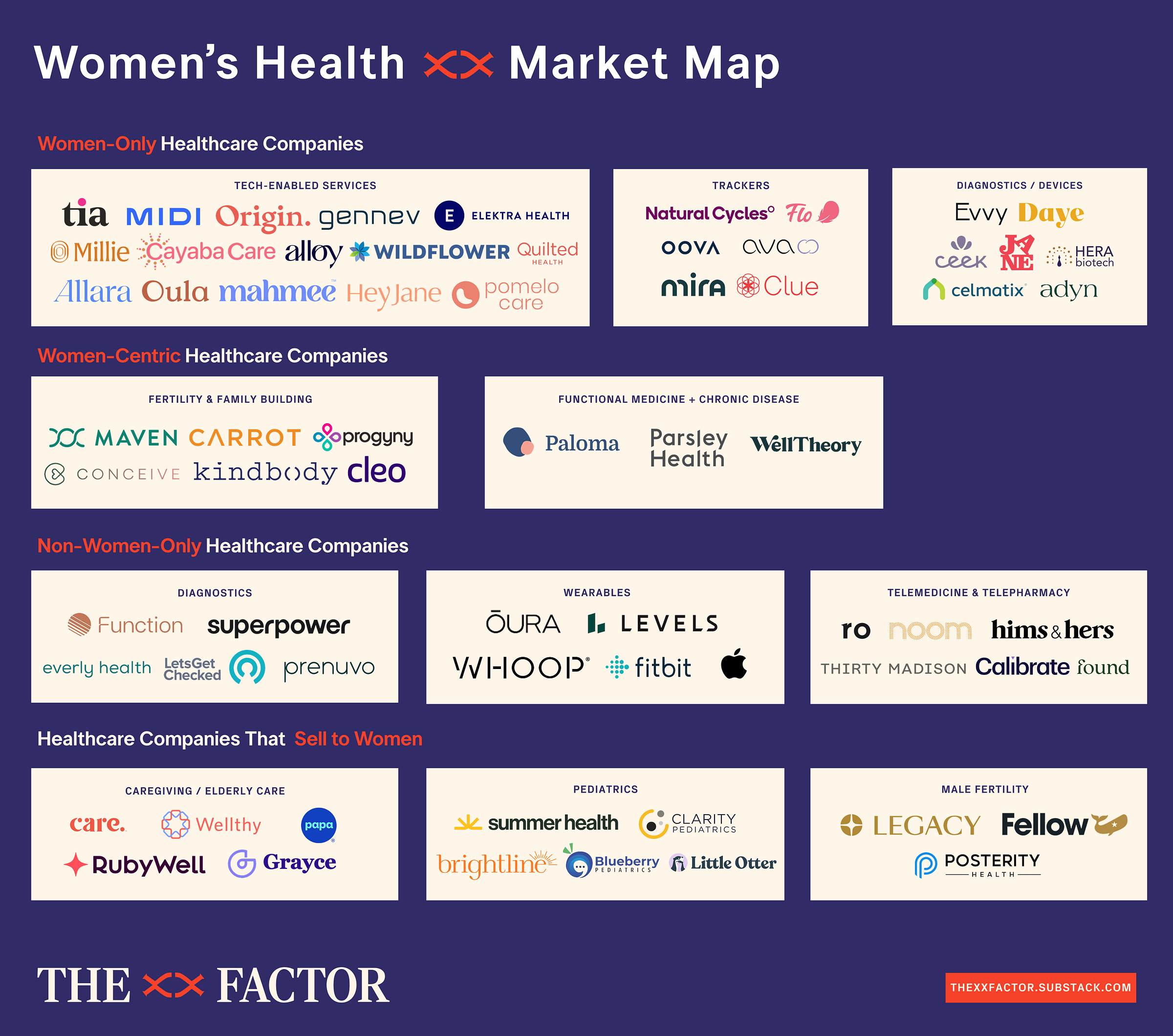

A new market map for women’s health

By this definition, my market map is far more expansive than your typical analyst’s “femtech” report. I categorize women’s health companies in four buckets:

Women-only healthcare companies: These are companies founded with a dedicated mission to improve the health of women. Their products, care models and brands reflect this exclusive focus on a female patient or user. Examples: Midi (virtual menopause care) and Tia (women’s primary care).

Women-centric healthcare companies: These companies serve women as their primary customer, but also serve men — either for practical reasons (e.g. IVF requires men’s participation) or to broaden their TAM. This is common in fertility, as well as in chronic disease and functional medicine given women’s disproportionate disease burden. Examples: Maven (women & family health benefits) and Parsley Health (“root-cause” medicine)

Non-women-only healthcare companies: Yes, this is a mouthful (better naming recommendations welcome! 🤣), but a fascinating and rapidly growing group. These are companies that did not start with a focus on women’s health — in some cases, they were actually founded with a focus on men’s health — but have developed features, products, and in some instances, dedicated brands, targeting women’s health needs overtime. For some of these companies, women actually make up the vast majority of their users or patients. Examples: Oura (a smart ring for your health) and Hims & Hers (DTC prescriptions) — keep reading for a dive deep on these players!

Healthcare companies who sell to women: this last bucket is least obvious, but is a greenfield opportunity. It includes players in the caregiving space — women are the predominant caretakers of both aging parents and kids — as well as the nascent but growing male fertility market, where women are often the primary purchasers or act as influential “nudgers” for their male partners. Leslie Schrock has written a lot about this phenomenon of marketing to women as conduits to men! Examples: Summer Health (virtual pediatric care) and Legacy (at-home sperm testing)

And this doesn’t even account for the “for everyone” healthcare companies that serve women as part of their broad-based offering. Everyone from One Medical to Lyra to Teladoc to your local hospital falls into this last bucket (not pictured).

A focus on women is good for your bottom line

So what do all of these companies have in common? They recognize that centering their products or marketing strategies on women is not virtue signaling, but smart business. They know that…

Women are the best customers. As I wrote about last week in xx.01, women spend 25% more of our lives in poor health than men. A contradictory byproduct of the healthcare system failing us is that we use it more. More needs = more spend — especially in our peak reproductive years when we spend nearly twice as much as men spend on healthcare.

Women make the bulk of care decisions. The common refrain that women are the “Chief Medical Officers” of our households controlling 80% of U.S. healthcare dollars isn’t just a cliché; more often than not, women decide when, what, where and from whom our children, partners and aging parents get care.

Women’s hormonal health is inextricably connected to other areas of health, creating natural product synergies. Take mental health and maternal health: treating postpartum depression effectively requires a nuanced understanding of the hormonal shifts that occur after pregnancy. Or consider metabolic health and menopause: helping women in midlife mitigate weight gain isn’t simply a matter of diet and exercise — it requires addressing the rapid decline in estrogen that occurs during menopause.

With growing recognition of these three factors, more and more companies outside of the narrowly defined “women’ health” space are integrating women-specific products into their businesses. Take Hims: in their last earnings call, they reported that 30% of their business is now coming from their female offshoot, Hers, which makes Hers a ~$700M business unto itself based on a projected ~$2.4 billion in company-wide revenue for 2025. Whatever you may think about their offering and tactics (I have a lot of opinions that I will hold on sharing for now!), Hers is larger (from a top-line POV) than the majority of “women-only” health businesses in the market right now. And just last week, weight loss player, Noom, announced they are launching a hormone replacement therapy (HRT) program for women in menopause. Why? Noom knows that women in mid-life are the biggest users of GLP-1s, and that early research shows that GLP-1s paired with HRT drives greater weight loss than GLP-1s alone.

Yes, women’s health can make you money… but, how you go after the opportunity matters!

While these non-women-only healthcare companies moving into women’s health may have a shared business rationale, they’ve gone about building for and marketing to women in wildly different ways — some more successful than others.

Done wrong, these efforts can feel like “pink-washing,” exploitative of women’s distinct challenges, and even outright predatory. Done right, however, these non-women-only healthcare companies can deliver real value to women while rapidly improving their bottom line.

Oura: a case study on expanding into women’s health the right way

Oura stands out from the crowd as the pinnacle example of how to build for women as a non-women-only healthcare company authentically and differentially. And it's working incredibly well. Next time you see a group of 30-something women, take a look at their hands and I almost guarantee you'll find multiple shiny rings, discreetly capturing their biometric data.

For those unfamiliar, Oura is a wearables company founded in 2013 with a mission to improve sleep and overall wellness. They were a first mover in the wearables and quantified self space, and mostly used by techy biohacker types in their early days. From the get-go, they nailed the hardware and built a wearable device you might actually want to wear — a strong foundation in design that helped them win women over later on.

But they struggled to "cross the chasm" to mainstream adoption until 2022. That's when they brought in a new CEO, Tom Hale, who has catapulted the business from 1M rings sold to 2.5M rings sold. The company is now valued at a whopping $5.2 billion according to their most recent financing at the end of 2024. A core part of their strategy that unleashed such rapid growth? Building for women.

Today, Oura is the leading women's health wearable with millions of female customers who use their product daily to track their health holistically — from their sleep and workouts to their cycles and pregnancies. As a result, their user base has flipped from predominantly male to predominantly female; today, ~60% of Oura users identify as female.

What Oura got right:

1. They focused on product vs. marketing.

Put simply, they built killer features — in large part through partnerships (see below) that deliver real value to women. It's quite simple actually, but hard to do in practice. Most others focus too much on marketing and efforts to "speak female,” which can feel really cringey, and neglect to sufficiently invest in building great products that actually solve problems for women.

2. Oura entered the women's health space with humility via strategic partnerships that built trust.

Oura has their own cycle tracking capabilities with cutting-edge temperature sensors, heart rate variability monitoring, and sleep analysis. Nonetheless, they chose to partner with Natural Cycles — the first FDA-cleared birth control app — a brilliant 1+1=3 integration. Natural Cycles' algorithm gained access to Oura's superior temperature data, which eliminated the need for the clunky thermometer, while Oura gained instant credibility in the reproductive health space. This built trust with women as a new entrant to the category.

3. Oura builds for women across life-stages.

Rather than limit their offering to a subset of women with a point-in-time issue, they provide tangible value to women through reproductive life chapters and beyond. As an example, Oura + Natural Cycles can help you avoid pregnancy (as effective as the birth control pill), predict your period and ovulation to help you get pregnant, monitor changes during pregnancy and postpartum, and navigate (and I bet, soon predict) perimenopause and menopause. Moreover, they show you how these hormonal shifts impact your sleep and heart rate with a “cycle-aware” lens, and give you tactical tools to achieve your goals at any stage of life. Hello retention!

4. Oura is proving it with research — again relying on partnerships to build credibility.

They've collaborated with UC Berkeley and Clue on a menopause study examining temperature changes during the menopausal transition, UCSF on a cutting edge PCOS study, and just announced a first-of-its-kind pregnancy study with Scripps Research on biobehavioral changes during pregnancy. These kinds of efforts demonstrate an authentic commitment to closing the gender research gap and advancing women’s health, not just making marketing claims.

5. Oura has prioritized privacy

This is essential in women's health and evermore so in our current post-Dobbs world. They've implemented clear data controls that allow users to delete cycle data independently from other health metrics, established strong data encryption practices, and transparently communicate how data is stored and used. They've also publicly committed to “oppose requests from legal authorities to access data for surveillance or prosecution purposes” — positioning themselves as a trustworthy ally at a time when the privacy of women’s health data is increasingly uncertain.

In talking to the Oura team on the "how," some softer things stand out to me:

Real executive buy-in: In every interview I’ve listened to with Oura's CEO, women's health is mentioned as a top 3 (if not #1) priority. While I've never sat in on an internal All Hands, I can tell from others I know who work at the company that this is not lip service, but real tangible belief with resources to back it.

A horizontal vs. vertical approach: Women's health is not managed as its own business unit, but rather, is a horizontal layer across the whole organization — from product to marketing to commercial to legal. In practical terms, this means that there's not a "small team in the corner" working on women's health in a silo, but rather, everyone across every function is thinking about building better for women as core to their job.

A clear mission and clarity on their lane: As Lindsey Belknap, one of Oura's marketing leaders told me, "Oura's north star when it comes to women's health is to improve body literacy so that women can better understand their bodies and make more informed choices for themselves." They're not trying to be your doctor, or replace your doctor, but rather, a tool that can give women — the majority of whom don't actually have a doctor — tangible insights that can put them in the driver's seat of their own health.

Oura provides a best-in-class example of how to build for women’s health that’s a win for women and for business. Their success demonstrates that women’s health is not a niche category but a massive, high-growth market opportunity. By focusing on real product value, building trust through strategic partnerships and research, and prioritizing privacy, Oura has set a blueprint for other non-women’s health companies to follow.

The elephant in the room: is this trend of expanding into women’s health a good thing?

I recognize this is a sensitive topic within the women's health and female founder communities. You can’t answer this without taking into account who is running these companies and the access to capital that comes with that. Yes, it’s true that women-only and women-centric healthcare companies remain underfunded as a group as compared to the non-women-only ones. Is this because they serve women in addition to men? Because their founders or CEOs are men? Or because they've built really strong businesses? Likely, it’s a mix of all three.

Nonetheless, I believe the growing trend of every company becoming a “women’s health” company can be a net positive — if it's done with intention and care, as Oura has demonstrated, rather than as a superficial branding exercise or a quick way to pad revenue.

First and foremost, the market is enormous as is the need to improve health outcomes for women. More players innovating in women’s health means more opportunities to expand access, close gaps in care, and deliver better solutions to the women who need them.

Second, these non-women-only healthcare players can help shift the capital landscape. By proving the growth and exit potential in women’s health to the market, they can help improve the flow of capital to the women-only and women-centric companies. From personal experience fundraising in this space, I can tell you the more examples of multi-billion dollar companies doing three or four digit revenue in women’s health, the better.

We’ve all been saying the women’s health category needs more unicorns and more exits. The solution isn’t narrowing what qualifies as "women’s health” — it’s broadening the definition. When we do, we unlock more innovation, more investment, and ultimately, better outcomes for women.

If you enjoy my writing, click the ❤️ or 🔄 button on this post so more people can discover it on Substack.

And if you’re new here, I encourage you to check out my last issue, xx.01, on the trillion dollar women’s health opportunity here, and more about my personal mission in creating The XX Factor here.

Awesome article! I completely agree that the definition of “women’s health” needs to be broadened to ensure that solutions are actually improving the overall health of women. Loved the point about the importance of trust...And for the non-women-only company, perhaps "women-inclusive" healthcare companies!

Excellent summary and terrific insights on Oura!