Part III: Kickstarting Your Women's Health Business Without VC

Right fuel, right business model, right time!

This post is Part III of a three-part series by Carolyn Witte and Leslie Schrock co-published on Second Opinion and The XX Factor to help women’s health founders raise money in the rapidly growing but still nascent women’s health category. Our goal is to offer a practical, founder-first framework to help you decide if, when, and how to raise venture—and what to do if that’s not the best path for you.

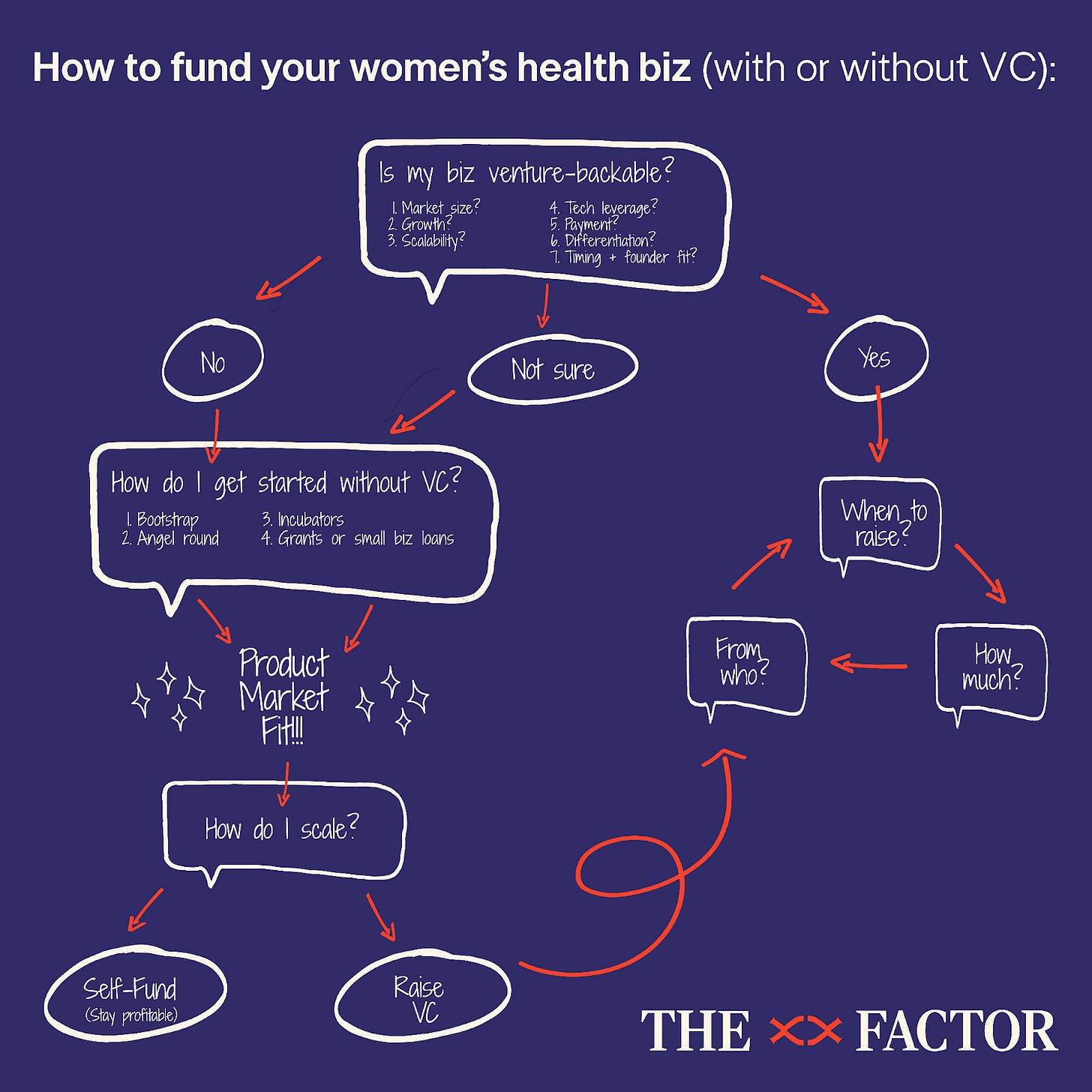

ICYMI, Part I breaks down what makes a business venture-scale and why investor math matters; and Part II dives into when to raise, how much, and from whom. If VC is not the best path for you or your business, Part III is for you!

Improving women’s health is a trillion-dollar opportunity—a moral and economic imperative with ripple effects across every aspect of society. Realizing that opportunity will take many different types of businesses. Some will be venture-scale and serve millions. Others won’t. And that’s okay.

A few reminders as you chart your own path…

First—venture capital isn’t the right fuel for every business

Companies that can become profitable quickly, operate leanly, and grow sustainably often don’t need—or benefit from—VC dollars. In women’s health, this includes lifestyle businesses, community and media platforms, and some consumer products. We’ve seen great examples of profitable newsletter companies or vendors selling supplements (a few examples: The ‘Pause Life by menopause doctor Mary Claire Haver, or nutritionist-founded Inessa) that never raise a dime of dilutive capital. Care delivery businesses—whether virtual or brick-and-mortar—tend to be more capital-intensive, but even there, we’ve seen targeted models scale profitably without venture; they just tend to do so more gradually.

Second—delaying raising venture does not mean never raising outside capital

Even if your business isn’t a fit for venture right now—or you’re not sure yet—that doesn’t mean the door is closed forever. In fact, it might be the smartest way to keep your options open. Some of the most successful healthcare companies started without outside funding, growing sustainably before raising on their own terms.

Take ChenMed, for example—one of the most successful value-based care companies in the U.S. Founded in Miami Gardens, the company was bootstrapped for nearly 30 years before taking in a single dollar of outside capital. Today, the company operates more than 100 clinics serving tens of thousands of patients with a highly respected financial and clinical model. Only after proving their model over decades did they accept outside funding—a 2023 private equity financing led by KKR that valued the company in the billions. We’ll save the nuances of VC versus PE for a different post, but tl;dr PE typically goes for scaled, profitable businesses versus early stage, higher risk plays.

(See the bottom of this chart that sends you back to the “raise” route post-PMF when you’re ready to scale!👇)

There are other ChenMeds out there quietly operating profitable companies, often founded outside of Silicon Valley. They may fly under the radar, but they should be a beacon of hope for women’s health founders who are mission-driven and building something incredible, but may find themselves in the “not sure if my business is venture-scale” bucket.

By the way, if that’s you, this isn’t a ding. Building something out of nothing in a category that barely existed ten years ago—with no large exits that founders or investors can point to—is hard. Taking time gives you more leverage, more control, and a greater chance of raising the right amount of money from the right investors—on your terms (and all of that stuff we just talked about in Part II!).

Okay, but if not venture, then what? How do I fund my business or even get started?

We get it. Not everyone has a nest egg—or friends and family who can write a check. You need money to pay yourself and a team to help you build. There are no easy answers, but continuing to chase venture when that’s not the right path is the worst route of all.

Four ways to get your business off the ground without VC :

1. Bootstrap

The cost of launching a business, even in healthcare, has dropped significantly and continues to decrease with the help of AI. You can now “rent” almost everything from an EHR, a medical group, or a clinical team via Wheel or SteadyMD. Even if your idea is venture-backable, there is a rising class of bootstrapping solopreneurs drawn to this route by the level of control it affords.

Advantages: You maintain full ownership and build business discipline early (aka you don’t have money to waste)

Watch-out-fors: Burnout risk and growth plateaus if you can't reinvest + scale quickly once you find product market fit

2. Angel/Friends & Family Round

To state the obvious, this is a privileged option not available to everyone. But if you tap your network for initial pre-seed capital, it can give you enough to build a proof of concept or hit early traction milestones that may unlock VC (or more bootstrapping) later.

Advantages: It's often faster and more flexible than institutional VC; we recommend using a SAFE as a “low-overhead” way to get started here (see Part II of this guide for details). If some of them are already active angel investors (and we both suggest, from experience, ensuring that they understand the risk/reward of early-stage investing if they’re not), they can also open their networks.

Watch-out-fors: It can be a slog; you can spend a lot of time raising “baby checks” that don’t add up to much, distracting you from business building (which undermines the purpose of this route). Also, and we know we are repeating ourselves here, ensure your investors are all accredited and truly understand the risks associated with early-stage investing—namely that they may not ever see this money again. It will change the nature of your relationships, and the business will absolutely be a frequent topic of conversation during your downtime. We suggest having a direct conversation about the downside scenario before accepting a check from family or friends.

3. Incubators & Accelerators

Leslie saw firsthand the power of community, network, and education as part of the founding team at Rock Health. Now, programs like Y Combinator, Techstars, and StartUp Health still offer early capital, hands-on support, and access to active investor networks. There are also a handful of healthcare-specific and women-focused options: Cedars-Sinai Accelerator focuses specifically on healthcare innovation and health system validation. FemTech Lab and Daya Ventures support women’s health founders. The Female Founder Collective offers a networked, women-led approach to helping early-stage startups across various sectors.

These programs can be especially valuable for first-time founders looking for community, mentorship, and exposure. But be selective—some are more healthcare-savvy than others, and all will take a sizable chunk of equity for a relatively small investment.

Advantages: Great for first-time founders looking for community, mentorship, and access to fundraising networks

Watch-out-fors: You tend to give up a lot of ownership (7-15%) for a relatively small check. Not all programs are built for the complexity of healthcare, and those that accept companies across all industries do not always have the same depth of understanding of its challenges. If you’re looking for connections to health systems, for example, this may not be possible. No matter what, ensure the accelerator understands your market/offering, and can add real value to make it worth the squeeze.

4. Grants & Small Business Loans

This path is becoming more stark in our political and economic climate, but there are still non-dilutive funding sources out there that can support women and women’s health founders.

Government Grants & Programs:

SBIR/STTR: Federal grants supporting R&D-heavy startups (e.g. diagnostics, digital health tools). Women- and minority-owned businesses may qualify for additional support. Note: these programs still appear to be active even amidst federal funding cuts (a reauthorization bill has been introduced in Congress to extend the programs through 2028). However, this is a moving target for obvious reasons, so monitor this route closely.

State/local economic development programs: Many states (e.g. California, New York, Massachusetts) have startup-specific grants or low-interest loan programs for small businesses and, more specifically, healthcare and biotech founders.

Nonprofit & Philanthropic Capital:

Melinda French Gates’ Pivotal Ventures: offers funding for both for-profit and nonprofit orgs working to improve women’s health (and is a proud investor in Tia!). Last year, Pivotal launched a $250 million open call to organizations working to improve the mental and physical health of women and families.

Tory Burch Foundation Fellows Program: offers $5K grants for women founders and access to a business education network

Small Business Loans:

Hello Alice: offers regular grant and loan programs for small businesses, especially women and minority-owned.

SBA 7(a) Loans: government-backed small business loans, often with lower interest rates and longer repayment terms

Community Development Financial Institutions (CDFIs): Local lenders that offer affordable financing and support to underrepresented founders.

Advantages: Non-dilutive capital = no ownership loss

Watch-out-fors: Bureaucratic applications and long timelines

When to go back to the drawing board

We hesitate to recommend this lightly as over-rotating for the market is (usually) bad. But if you’re hitting a wall or none of these paths feel viable, it’s worth asking yourself: can I tweak my business to unlock either (a) more capital efficiency (so I can bootstrap, etc) or (b) venture-scale potential?

Capital-lite path: Reduce upfront costs to get to revenue/profitability faster

Venture path: Reframe your market or product to expand TAM or increase tech leverage

The Bottom Line

Women’s health is at an inflection point—and we’re finally seeing founders and funders take the opportunity seriously. But let’s not mistake attention for progress. If we want this category to succeed, we need to help women’s health founders build great businesses, not just raise capital.

While we’re still waiting for a women’s health IPO, there is room for many important companies to be built. Some will be venture-scale. Others won’t. Both play a role in advancing healthcare for women.

If your business is venture-backable, great! Go in with eyes wide open. Be intentional about when you raise, how much you raise, and who you raise capital from. Avoid early-stage traps like over-raising, over-building, and chasing vanity metrics. Anchor your strategy around product-market fit, payer clarity, and sustainable growth.

If your business isn’t venture-backable—or you’re unsure—don’t force it. Taper your goals so that bootstrapping is a viable option, or opt for an angel round or an accelerator program to support testing and iterating to a clear answer on whether raising venture is the right path for you.

As any successful founder will tell you, focus is the most essential skill of all. When it feels like you can do nothing else, step back and focus on building a product women love and a sustainable business model with strong fundamentals. If you do, the money—VC or otherwise—will follow.

If you enjoy my writing, click the ❤️ or 🔄 button on this post so more people can discover it on Substack.

And if you’re new here, I encourage you to check out some of my popular past issues on the trillion dollar women’s health opportunity here, the rise of non-women-only healthcare companies here, and what women’s health founders can learn from Hinge Health here.

I can’t thank you enough for this series. Such timely information and I’m in early stage 🤍

Totally agree - you should only raise VC capital if you have to! VC capital is powerful and seemingly glamorous but with real tradeoffs. Not every business needs it, and not every founder benefits from it 👏